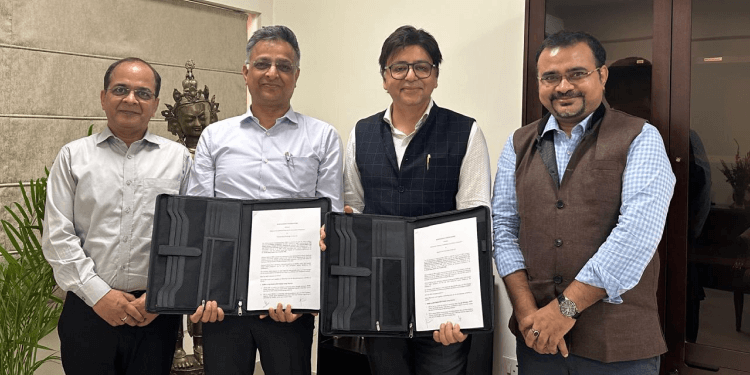

ICICI Prudential Life Partners With NSDL Payments Bank To Offer Insurance Products

ICICI Prudential Life Insurance has entered into a corporate agency agreement with NSDL Payments Bank, a subsidiary of NSDL, the largest depository of India. Under the agreement, ICICI Prudential Life will provide its customer-centric protection and savings products to customers of NSDL Payments Bank. These insurance products will enable NSDL Payments Bank customers to provide financial security to their families and help them achieve their financial goals.

This is also an effort by ICICI Prudential Life Insurance to cover the uninsured population of the country by offering its innovative and easy to understand life insurance POS products on NSDL Payment Bank’s exhaustive point of sale (POS) network, across the country. POS life insurance products are very easy to understand and can be purchased in a completely hassle-free manner. To start with, ‘iProtect Smart’, a term plan that offers protection and ‘ICICI Pru ASIP’, a unique savings product offering guaranteed maturity benefits, will be provided.

Mr. N S Kannan, MD & CEO, ICICI Prudential Life Insurance, said, “We are delighted to partner with NSDL Payments Bank. The key objective of both the partners is to leverage technology to provide a hassle-free and immersive experience to customers. This partnership will help the bank’s customers leverage our digital platform to conveniently purchase life insurance products. We believe our customer-centric protection and long-term savings products will enable NSDL Payments Bank customers to provide financial security to their loved ones and help them achieve their financial goals. This partnership is also a step towards fulfilling our commitment to address the huge protection gap in the country.”

Mr. Ashutosh Singh, CEO, NSDL Payments Bank said on this occasion, “We are looking at offering the whole suite of products to our customers either by building them out ourselves or through partnerships. The partnership with ICICI Prudential Life Insurance is a significant one as it will allow our customers the opportunity to discover some of the most relevant products for their lifestyle and income levels. COVID-19 has only just emphasized the importance of having the right insurance plans and adequate insurance covers, both of which we want to address through this partnership. Also, as over 70% of our customer base is under the age of 30, given our thrust on digital and CLICK-CLICK fulfilment journeys, we are very excited to help shape the right attitude and approach towards insurance and investment for this segment from an early age so that they and their families can reap the rewards later and tide over eventualities such as these with little or no financial damage.”